What is the Stochastic Oscillator and how to use it

The stochastic was developed by George C. Lane in the late 1950s.

It is a momentum indicator, which means that, according to its inventor, the Stochastic Oscillator “doesn’t follow price, it doesn’t follow volume or anything like that. It follows the speed or the momentum of price. As a rule, the momentum changes direction before price.”

There are basically three ways of using the Stochastic:

- overbought / oversold areas

- crossover between slow and fast lines

- divergences

- bull and bear set-ups specifically defined by the creator of the Stochastic Oscillator

The way the inventor Lane identified used to use the Stochastics was in fact by spotting bull and bear set-ups to identify probable price reversals.

The default setting for the Stochastic Oscillator is 14 periods, which can be days, weeks, months or an intraday timeframe.

A 14-period %K is calculated using the the highest high over the last 14 periods and the lowest low over the last 14 periods.

%D is the 3-day simple moving average of %K and it plotted alongside %K to act as a signal or trigger line.

How to calculate the Stochastics

%K = (Current Close – Lowest Low)/(Highest High – Lowest Low) * 100

%D = 3-day SMA of %K

Lowest Low = lowest low for the specific period

Highest High = highest high for the specific period

%K is multiplied by 100 to move the decimal point two places

Interpretation

The Stochastic Oscillator measures the level of the close relative to the high-low range over a given period of time.

The Stochastic Oscillator is above 50 when the close is in the upper half of the range and below 50 when the close is in the lower half.

Oversold areas: low readings (below 20) indicate that price is near its low.

Overbought areas: high readings (above 80) indicate that price is near its high.

Fast, Slow or Full

There are three versions of the Stochastic Oscillator.

The Fast Stochastic Oscillator is based on George Lane’s original formulas for %K and %D.

%K in the fast version that appears rather choppy. %D is the 3-day SMA of %K.

In fact, Lane used %D to generate buy or sell signals based on bullish and bearish divergences.

Lane asserts that a %D divergence is the “only signal which will cause you to buy or sell.”

Because %D in the Fast Stochastic Oscillator is used for signals, the Slow Stochastic Oscillator was introduced to reflect this emphasis.

The Slow Stochastic Oscillator smooths %K with a 3-day SMA, which is exactly what %D is in the Fast Stochastic Oscillator.

Notice that %K in the Slow Stochastic Oscillator equals %D in the Fast Stochastic Oscillator (chart 2).

Fast Stochastic Oscillator:

Fast %K = %K basic calculation

Fast %D = 3-period SMA of Fast %K

Slow Stochastic Oscillator:

Slow %K = Fast %K smoothed with 3-period SMA

Slow %D = 3-period SMA of Slow %K

The Full Stochastic Oscillator is a fully customizable version of the Slow Stochastic Oscillator.

Users can set the look-back period, the number of periods to slow %K and the number of periods for the %D moving average.

The default parameters were used in these examples: Fast Stochastic Oscillator (14,3), Slow Stochastic Oscillator (14,3) and Full Stochastic Oscillator (14,3,3).

Full Stochastic Oscillator:

Full %K = Fast %K smoothed with X-period SMA

Full %D = X-period SMA of Full %K

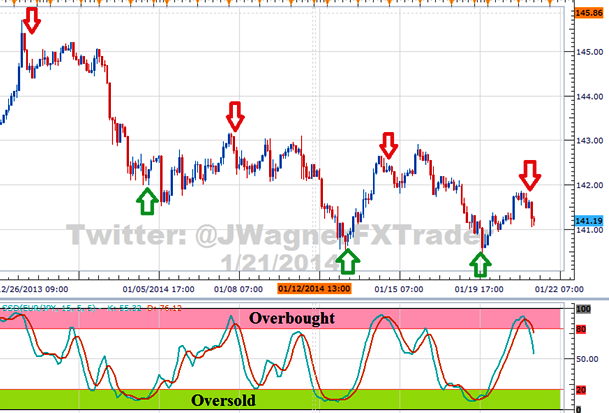

Overbought and Oversold areas

As a bound oscillator, the Stochastic Oscillator makes it easy to identify overbought and oversold levels.

The oscillator ranges from zero to one hundred.

No matter how fast a security advances or declines, the Stochastic Oscillator will always fluctuate within these two values: 0 – 100.

Traditional settings use 80 as the overbought and 20 as the oversold threshold.

Readings above 80 for the 20-day Stochastic Oscillator would indicate that the underlying asset is trading near the top of its 20-day high-low range.

Readings below 20 occur when a security is trading at the low end of its high-low range.

A longer period (20 days versus 14) and longer moving averages for smoothing (5 versus 3) produce a less sensitive oscillator with fewer signals.

Dips below 20 warn of oversold conditions that could precede a bounce.

Moves above 80 warn of overbought conditions that could foreshadow a decline.

The indicator is both overbought AND strong when above 80.

A subsequent move below 80 is needed to signal some sort of reversal or failure at resistance (red dotted lines).

Conversely, the oscillator is both oversold and weak when below 20.

A move above 20 is needed to show an actual upturn.

It is important to note that overbought readings are not necessarily bearish and oversold readings are not necessarily bullish.

What does that mean?

Notice how the oscillator can remain above 80 for a long time and still the security goes up in price.

Similarly, the oscillator can stay below 20 without necessarily bouncing back up and the price keeps going down.

In other words, securities can become overbought and remain overbought during a strong uptrend.

Closing levels that are consistently near the top of the range indicate sustained buying pressure.

Similarly, oversold readings are not necessarily bullish as securities can also become oversold and remain oversold during a strong downtrend.

Closing levels consistently near the bottom of the range indicate sustained selling pressure.

It is, therefore, important to identify the bigger trend and trade in the direction of this trend.

Look for occasional oversold readings in an uptrend and ignore frequent overbought readings.

Similarly, look for occasional overbought readings in a strong downtrend and ignore frequent oversold readings.

How to use the Stochastic with crossover

You can also use the Stochastic as signals generation through the crossover between the Stochastic and its trigger.

When using Stochastics in a downtrend, the sell signal is generated when the lines %K and %D go from above 80 to below 80.

When using Stochastics in an uptrend, the buy signal is generated when when the lines %K and %D go from below 20 to above 20.

We tend not to give a lot of importance to the crossovers beetween these two lines in the area between 20 and 80, as a way to increase our odds for a successfull trade.

You can decide whether to use the Slow or the Fast Stochastic.

The concept is the same, just make your test on the securities to understand which one work better.

Here are some other examples.

You can apply to Stochastic also to options trading, like in the chart below.

Bull Bear Divergences

Divergences form when a new high or low in price is not confirmed by the Stochastic Oscillator.

A bullish divergence forms when price records a lower low, but the Stochastic Oscillator forms a higher low.

This shows less downside momentum that could foreshadow a bullish reversal.

A bearish divergence forms when price records a higher high, but the Stochastic Oscillator forms a lower high.

This shows less upside momentum that could foreshadow a bearish reversal.

Once a divergence takes hold, chartists should look for a confirmation to signal an actual reversal.

A bearish divergence can be confirmed with a support break on the price chart or a Stochastic Oscillator break below 80, which is the centerline.

A bullish divergence can be confirmed with a resistance break on the price chart or a Stochastic Oscillator break above 20.

You can also use the 50-level to filter out wrong signals.

A Stochastic Oscillator cross above 50 signals that prices are trading in the upper half of their high-low range for the given look-back period.

Conversely, a cross below 50 means prices are trading in the bottom half of the given look-back period.

Bull Bear Set-ups

George Lane identified another form of divergence to predict bottoms or tops.

A bull set-up is basically the inverse of a bullish divergence.

The underlying security forms a lower high, but the Stochastic Oscillator forms a higher high.

After that, the next decline is then expected to result in a tradable bottom.

A bear set-up is by the same token the inverse of a bearish divergence: the price of the security makes a higher low but the Stochastic makes a lower low.

The next climb may represent an interesting entry signal for a short entry point.

Chart 8 shows Network Appliance (NTAP) with a bull set-up in June 2009.

The stock formed a lower high as the Stochastic Oscillator forged a higher high.

This higher high shows strength in upside momentum.

Remember that this is a set-up, not a signal.

The set-up spots a possible tradable low in the near future.

In the chart below, NTAP declined below its June low and the Stochastic Oscillator moved below 20 to become oversold.

Traders could have acted when the Stochastic Oscillator moved above its signal line, above 20 or above 50.

Alternatively, NTAP subsequently broke resistance with a strong move.

A bear set-up occurs when the security forms a higher low, but the Stochastic Oscillator forms a lower low.

Even though the stock held above its prior low, the lower low in the Stochastic Oscillator shows increasing downside momentum.

The next advance is expected to result in an important peak.

Motorola Chart shows a bear set-up.

The stock formed a higher low in late-November and early December, but the Stochastic Oscillator formed a lower low with a move below 20.

This showed strong downside momentum.

The subsequent bounce did not last long as the stock quickly peaked.

Notice that the Stochastic Oscillator did not make it back above 80 and turned down below its signal line in mid December.

Statistical evidence of the Stochastic Oscillator

A recent study by ETF HQ has proven that the highest returns have been produced going long when the Stochastic is between 90 and 100.

Here are the statistic results.

Let’s quote the wording of this site.

“Clearly most of the market gains occurred while the Stochastic Oscillator was above 50 and the lion’s share when it was above 90.”

“What this means is that when the market is in the top 50% of its range it has a tendency to go up and when it is in the top 90% of its range it has a strong tendency to go up. “

“Interestingly, the returns do not change much over the different look back periods although the benefit of a longer look back is less volatility from the signals.”

“It also tells us that we want to avoid being long when the market is in the bottom 50% of its range.”

“Over what period do we base this range? Interestingly, the returns do not change much over the different look back periods although the benefit of a longer look back is less volatility from the signals.”

“… you need to be long when the market is making new highs if you want to make money. Over a 255 day look back (about 1 year) the difference between going long in the 50-90 range vs the 50-100 range is the difference between making 2.68% or 8.38% a year.”

And again “The message coming through loud and clear is that you need to be long when the market is making new highs if you want to make money”

Conclusions

While momentum oscillators are best suited for trading ranges, they can also be used with securities that trend, provided the trend takes on a zigzag format.

Pullbacks are part of uptrends that zigzag higher.

Bounces are part of downtrends that zigzag lower.

In this regard, the Stochastic Oscillator can be used to identify opportunities in harmony with the bigger trend.

The indicator can also be used to identify turns near support or resistance.

Should a security trade near support with an oversold Stochastic Oscillator, look for a break above 20 to signal an upturn and successful support test.

Conversely, should a security trade near resistance with an overbought Stochastic Oscillator, look for a break below 80 to signal a downturn and resistance failure.

The settings on the Stochastic Oscillator depend on personal preferences, trading style and timeframe.

A shorter look-back period will produce a choppy oscillator with many overbought and oversold readings.

A longer look-back period will provide a smoother oscillator with fewer overbought and oversold readings.

Like all technical indicators, it is important to use the Stochastic Oscillator in conjunction with other technical analysis tools.

Volume, support/resistance and breakouts can be used to confirm or refute signals produced by the Stochastic Oscillator.